Physical Settlement

Overview

ECC has a high level of expertise in the physical settlement of grid-bound energy (power, natural gas) and energy related products (emission allowances).

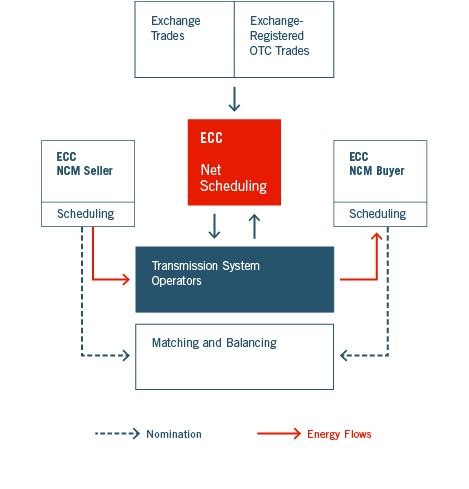

ECC is responsible for physical settlement of traded or registered contracts. Nomination includes scheduling of local markets of ECC’s Partner Exchanges and the nomination of cross-border power deliveries as part of various European market coupling initiatives. In this context, ECC assumes the role of the crossborder shipping entity, thus contributing to the further integration of the European electricity markets.

Furthermore, ECC is linked to the Union Registry to perform the delivery of emission allowances. Additionally, since 2016, ECC is connected to the French Registry for Capacity Guarantees.

ECC Physical Settlement

| Power | Natural Gas | Environmentals |

|

| Emission Allowances:

Guarantees of Origin Auction Trading for Power and Biogas French Capacity Guarantees nEHS |

| Title | Type | Category | Publishing date | File |

|---|---|---|---|---|

| ECC Delivery Accounts | Accounts | Physical Delivery Accounts | 2025-11-04 | pdf (201 KB) |

Nomination Process for Power and Natural Gas

Role of ECC and ECC Lux

As a Central Counterparty, ECC assumes the role of a market participant in the grid of the transmission system operators (TSOs). Nomination is provided by ECC Lux which has concluded a balancing area agreement with all major European TSOs.

Prerequisites and Responsibilities

Trading participants opting for physical settlement need a balancing area agreement with the relevant TSO. Alternatively, a third-party agreement permitting access to a balancing area can be concluded. For further details, please refer to the section Access to ECC.

From a legal perspective, Clearing Members are not involved in the physical settlement process as delivery is processed by ECC Lux. They act as a payment agent and guarantor.

The TSOs guarantee grid security through balancing of nominated amounts. In case of a mismatch, the special rules of the relevant transmission system operator apply.

Nomination & Scheduling Rules

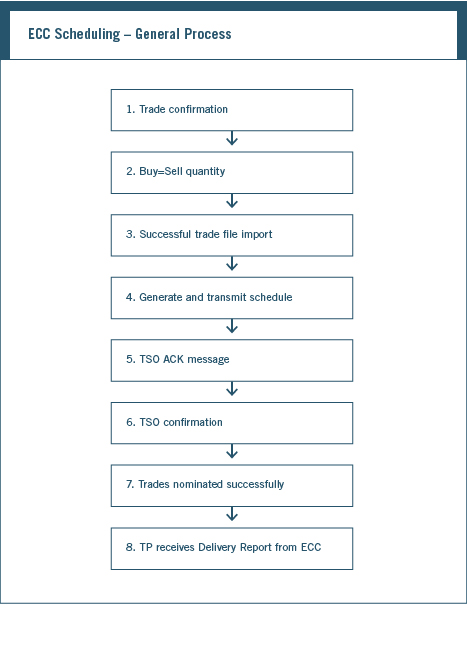

In the most power market areas and in the natural gas market, single-sided nomination is used. This means ECC is authorized to fulfil the physical nomination on behalf of each trading participant, no counter nomination from the customer is required.

In all other cases the priority nomination will apply. This means the trading participant also has to submit a schedule.

Details about Delivery rules and Delivery accounts are available here.

ECC nominates the net position in the relevant product to the respective TSO within the timeframe specified.

Market Coupling Power

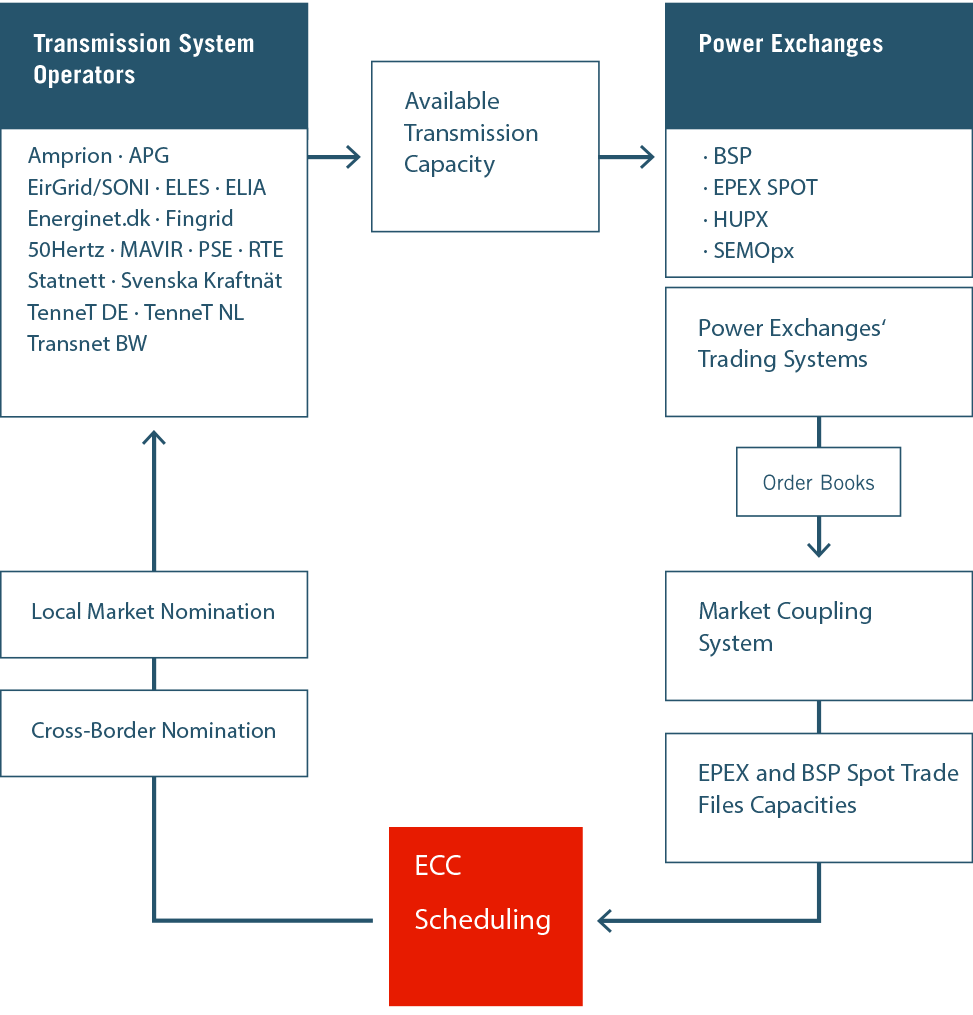

ECC supports the vision of an integrated cross-border wholesale energy market in Europe. Together with its Partner Exchanges, network operators and trading participants, ECC is involved in various projects for connecting European electricity markets, the so-called Market Coupling at both the Day Ahead and the Intraday Auction processes. Market Coupling refers to the implicit day ahead auction of cross-border capacities. It ensures fair and efficient access to cross-border capacities, a reduction of price volatility and the convergence of power prices across regions.

Market Coupling maximizes the social welfare and supports the creation of a pan-European market area for power.

Further Details can be found on the EPEX SPOT website.

Prerequisites and Responsibilities

Trading participants opting for physical settlement need a balancing area agreement with the relevant TSO. Alternatively, a third-party agreement permitting access to a balancing area can be concluded. For further details, please refer to the section Access to ECC.

From a legal perspective, Clearing Members are not involved in the physical settlement process as delivery is processed by ECC Lux. They act as a payment agent and guarantor.

The TSOs guarantee grid security through balancing of nominated amounts. In case of a mismatch, the special rules of the relevant transmission system operator apply.

Nomination and Scheduling Rules

As a dedicated clearing house, ECC provides clearing and settlement services for cross-border energy flows. It nominates the cross-border electricity flows to the transmission system operators (TSOs) and settles trades for all counterparties involved.

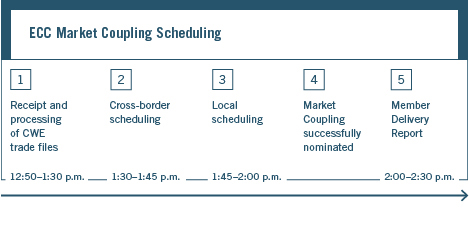

Day Ahead Nomination Scheduling

There will be one Day Ahead Auctions taking place on each delivery day (D):

Pan-European Intraday Auctions

There will be three Pan-European Intraday Auctions taking place on each delivery day (D):

a. IDA1: D-1 15:00 CE(S)T. Allocated period D [00:00-24:00]

b. IDA2: D-1 22:00 CE(S)T. Allocated period D [00:00-24:00]

c. IDA3: D 10:00 CE(S)T. Allocated period D [12:00-24:00]

ECC sends the nomination within 1 hour after the auction.

Details about Delivery rules and Delivery accounts are available here.

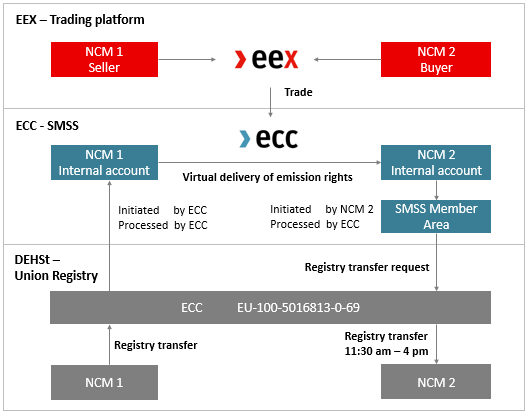

Emission Rights Process

Advantages of Settlement via ECC

ECC offers substantial expertise in the physical settlement of EUAs and CERs. Our external and internal account structure allows primary- and secondary-market EUAs to be segregated. ECC provides maximum security by guaranteeing the legal origin of the primary auction share of a given member’s EUA holdings.

Prerequisites and Responsibilities

Before trading, the certificates have to be delivered to the ECC registry account available here at UNION REGISTRY. Trades are fulfilled by means of transfers between ECC's internal delivery accounts. Trades are fulfilled by means of transfers between ECC's internal delivery accounts. There are no registry transactions.

Members have to ensure that they hold sufficient volumes in their account to fulfil their obligations on the delivery day. The expected balance of holdings is monitored. ECC contacts the member in case of a negative value. In case of non-delivery or a delivery default, ECC cancels the spot transaction or initiates a buy-in procedure.

After payment, the respective number of emissions is debited from the seller's account and the buyer's account is credited with said number of emissions. Internal account transfers are only possible from the primary market account to the secondary market account.

Trading participants opting for physical settlement with Registry delivery need a delivery account at UNION REGISTRY. In exceptional cases, a third-party agreement permitting access can be concluded. The account has to be setup as trusted account at ECC. For further details, please refer to the section Access to ECC.

At least two persons has to be setup as User with the right to check the current stock of your internal ECC Account (in all cases) and to initiate Registry Transfer Requests (RTR) of Emission Rights (only in case of existent Registry Account) within the ECC Member Area: Access to ECC.

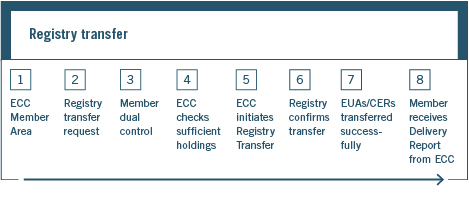

Delivery Process: Registry Transfer Request

A member can request a transfer of its holdings to any registry account at any time. The Registry Transfer Request has to be entered via the ECC Member Area. It needs to be approved according to the principle of dual control.

ECC checks the request against the members' actual holdings and subsequently initiates the transfer. As soon as the member has entered a Registry Transfer Request, its holdings are blocked. The account balance is updated after’s successful transfer.

| Title | Type | Category | Publishing date | File |

|---|---|---|---|---|

| ECC EUA Delivery Process Guideline | Processes | Physical Delivery Process | 2024-08-09 | pdf (444 KB) |

| EUA Expiry Timeline | Processes | Physical Delivery Process | 2024-08-09 | pdf (214 KB) |

nEHS

Fuel emissions trading has been in force in Germany since 1st January 2021. The instrument will set a CO2 price for the heat and transport sectors at a national level for the first time, as previously this has not been covered by the European Emissions Trading Scheme (EU ETS).

All CO2-emitting fuels placed on the market, in particular petrol, diesel, heating oil, liquefied petroleum gas, natural gas and coal, are included in the nEHS. The obligated parties under the nEHS are those who place fuels on the market, for example natural gas suppliers or companies in the mineral oil industry.

Prerequisites and Responsibilities

To take part in the nEHS sell-off, a registration at the UBA Registry as well as at the nEHS Admission Portal is required. Participation in sell - offs is possible via intermediary or direct access.

Delivery Process

Sell-offs take place every Tuesday and Thursday from 9.00 am – 3.00 pm (except for T2 – holidays).

For Non-Clearing Members, Clearing Members and Direct Clearing Participants delivery of the certificates within the UBA Registry takes place one day after the respective sell-off on Wednesdays and Fridays between 3 pm and 4 pm.

For DCP-nEHS customers (special form of EEX/ECC membership for nEHS access only) delivery of certificates takes place on the day after the sell-off on which the money was received (max. after six business days):

- Sell-Off on T (Tuesday or Thursday)

- if payment is received by T+2*, 11 a.m.**: delivery on T+3*

- otherwise one-time extension of the payment deadline until T+5*, 11 a.m.** and delivery on T+6*

- if payment has still not been received by then, the purchase contract will be cancelled***

Notes:

*In case the above dates fall on a T2 holiday, the deadlines will be postponed accordingly to the following ECC business day.

** The exact times are currently still being coordinated with the competent authority. Changes are therefore still possible.

***The above information may differ for the last sell-off date in December.

Please note that changes regarding the day of delivery for DCP-nEHS customers are still possible.

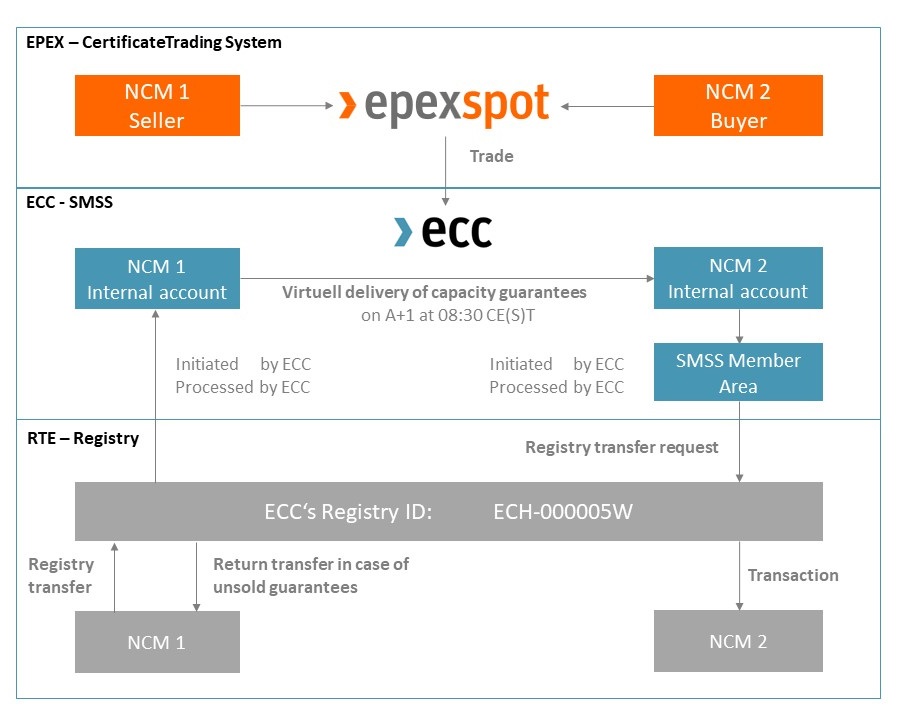

French Capacity Guarantees

ECC offers substantial expertise in the physical settlement of French Capacity Guarantees and has been a reliable partner in this market since 2016. The settlement system is connected to the French Registry for Capacity Guarantees in order to ensure an efficient and fast delivery to the customer accounts. Further details can be found at the EPEX SPOT website.

Prerequisites and Responsibilities

Trading participants needs a delivery account at the RTE Registry. In exceptional cases, a third-party agreement permitting access can be concluded.

The guarantees have to be transferred to ECC before the auction.

For further details, please refer to the section Access to ECC.

Delivery Process

All capacity guarantees sold are transferred by ECC after the auction to the respective buyer account with a delay of 26 hours. However, all guarantees unsold are transferred back to the seller account on the day after the auction immediately. No further request has to be created by the customer.

| Title | Type | Category | Publishing date | File |

|---|---|---|---|---|

| French Capacity Market | Processes | Physical Delivery Process | 2025-07-09 | pdf (203 KB) |

GO Futures Process

ECC provides services for the settlement of transactions in the GO market. Therefore, ECC takes advantage of the account structure of the French GO Registry operated by EEX AG.

Delivery Process

Details on the settlement of GO Futures are provided with GO Futures Delivery Process.

| Title | Type | Category | Publishing date | File |

|---|---|---|---|---|

| GO Futures Delivery Process | Processes | Physical Delivery Process | 2025-07-09 | pdf (143 KB) |

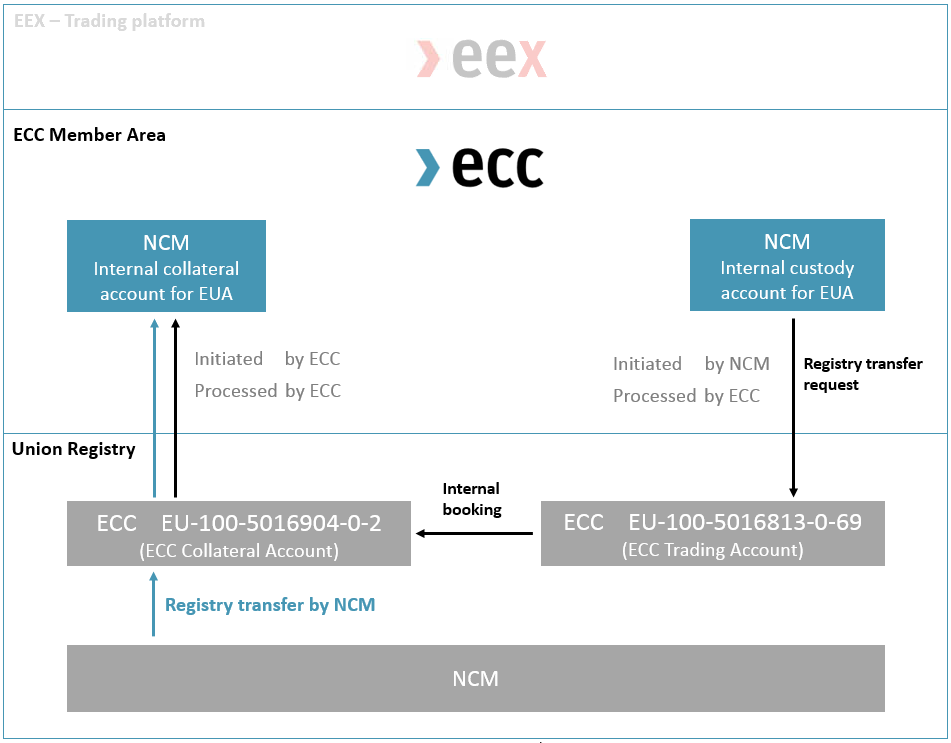

European Union Allowances (EUA) as margin credits

Prerequisites and Responsibilities

Further margin related information can be found on the ECC’s Risk Management website.

Delivery Process

In order to use general allowances as collateral

a) a direct transfer from your union registry account to ECC’s union registry collateral account or

b) a transfer from your internal custody account is necessary as shown below.

Both approaches and further conditions are described more in detail within the EUA as collateral – Guideline.

| Title | Type | Category | Publishing date | File |

|---|---|---|---|---|

| EUA as Collaterals | Processes | Physical Delivery Process | 2025-07-09 | pdf (178 KB) |

Reporting

Delivery Reports provide an overview of all physically settled trades to the members. More detailed reports can be accessed via the ECC Member Area.

Each report contains separate data for

- buy and sell transactions

- traded products

- different market areas

Additional information can be found in the example reports below.

For the purpose of physical delivery, positions are always netted out.

Timeline

Daily sending of Delivery Reports:

| Power | Delivery day D-1 | around 10:00 CET |

| Power Market Coupling | Delivery day D+1 | around 14:00 CET |

| NATGAS | Delivery day D-1 | around 10:00 CET |

| Emission | Delivery day D | around 17:00 CET |

Example Reports

| Publishing date | Title | File |

|---|---|---|

| 2025-01-21 | Delivery Report EUA Detail – Example | zip (954 B) |

| 2025-01-21 | Delivery Report EUA Summary - Example | zip (598 B) |

| 2025-01-21 | Delivery Report Natural Gas - Example | zip (1 KB) |

| 2025-01-21 | Delivery Report Power - Example | zip (4 KB) |