Default Management

Default Management

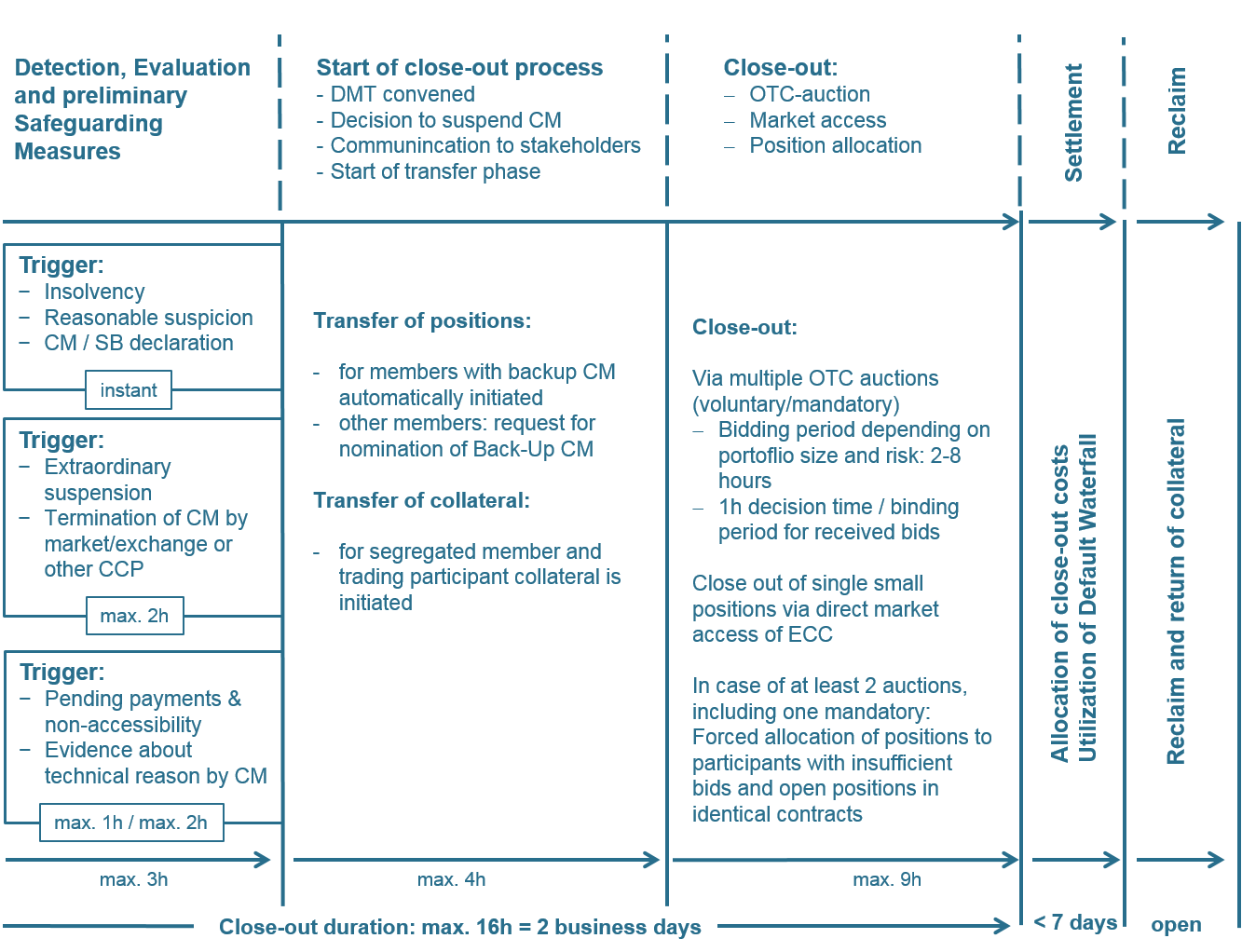

The Management Board of ECC declares the default of a Clearing Member and takes the key decisions on ECC´s measures during the management of a default. These measures shall follow the stipulations of the Risk Strategy and the Default Management Policy. As far as measures affect or require steps of Clearing Members or Non-Clearing Members, ECC shall act in accordance with the Clearing Conditions.

The Default Management Team consists of internal or external experts relevant for default management. Its task is to consult the Management Board and recommend actions from the set of available options in ECC’s default processes. In general, the DMT consists of the Default Manager and representatives of CCP Risk Models & Risk Analytics, Clearing Operations, Legal, Compliance, Regulatory Reporting & Bank Risk, Member Readiness, Corporate Communications, Clearing Sales and the representatives of ECC’s partner exchanges market operations departments.

Stop Payments and Releases of Collateral

- The release of collateral of the Clearing Member that has defaulted and any payout to this Clearing Member is withheld.

- The release of contributions to the clearing fund by other Clearing Members is stopped.

- ECC's liquidity is strengthened e.g. by borrowing cash against security collateral of the defaulting Clearing Member

Transaction and Position Transfer to a Backup Clearing Member

- All pending transactions and open positions of the Clearing Member and its clients are evaluated.

- Clients with segregated accounts and a backup Clearing Member are transferred to the backup Clearing Member. The remaining clients are provided with a specific timeline to name a new Clearing Member. ECC will support the clients transfer of positions and transactions to the new Clearing Member.

Netting of Open Positions and Transactions

Any remaining open positions and transactions are netted across proprietary and client positions. Open positions are evaluated and a close-out strategy is set by ECC’s Default Management Team.

This close-out strategy takes into account the characteristics of the open positions (such as daily transaction volume, current market situation) to ensure minimum disruption of the market and, at the same time, compliance with the principles of reasonableness and good faith in managing the closing-out of positions. ECC can use third parties to manage the close-out process.

ECC can also decide to keep positions if these do not entail any material risk. The close-out procedure can involve the markets ECC serves but also an auction by ECC. Clearing Members and trading participants in ECCs markets can be asked to participate in the close-out procedure on a voluntary basis. In the event that the close-out procedure makes use of an auction, participants will receive and be asked to fill out and return to ECC a bidding sheet. A sample sheet with explanation of the fields can be downloaded here.

Calculation of profits and losses from the close-out are calculated and the collateral is used. Collateral in segregated accounts is only used to cover losses from the specific segregated account, any remaining surplus is distributed to the segregated client or in case of an omnibus account to the specific omnibus representative. For general omnibus clients any remaining surplus is not returned to the defaulting clearing members administrator but instead used by ECC to satisfy existing claims of his clients of his regarding posted collateral. The clearing fund could be used.

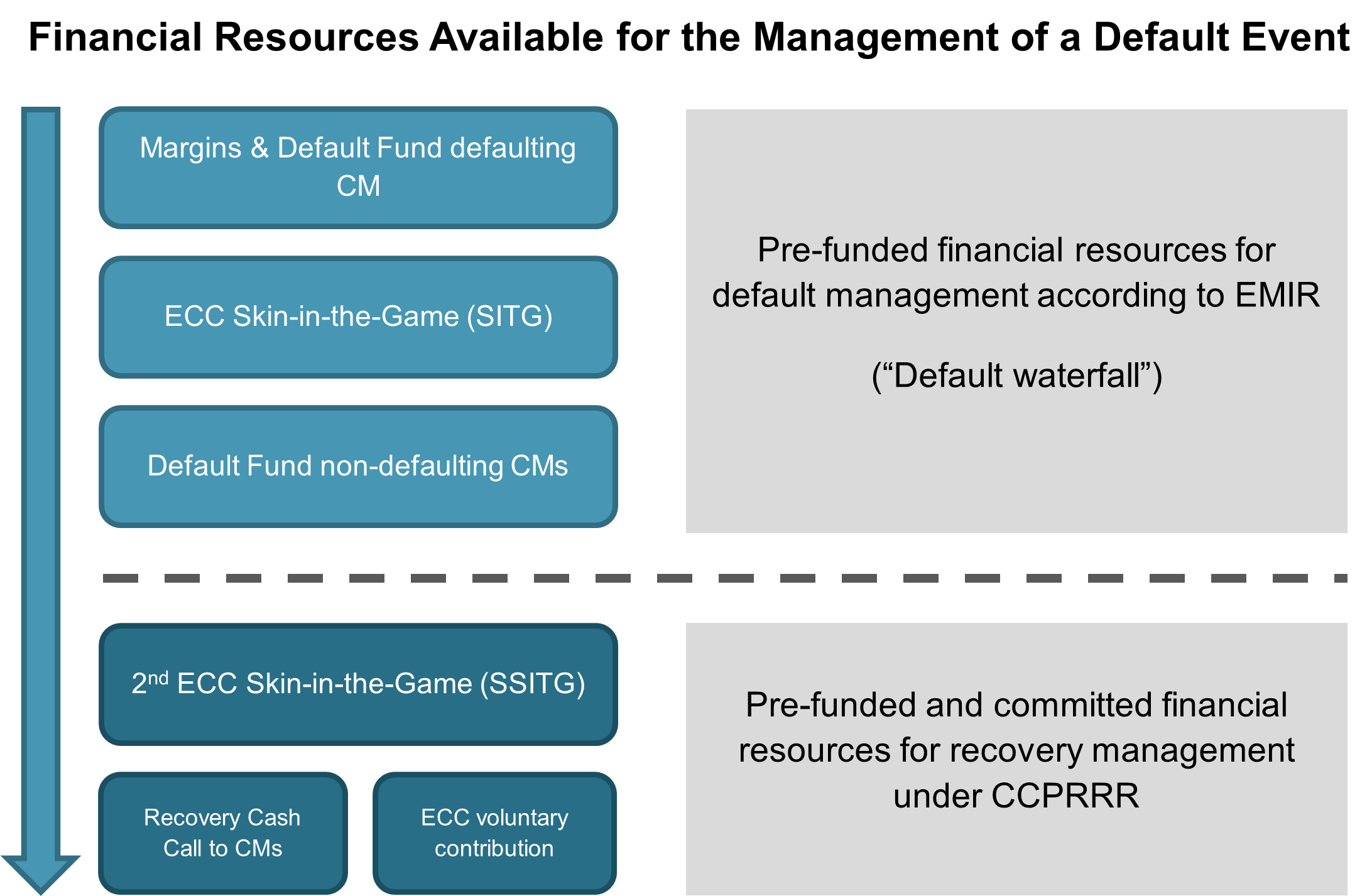

The default waterfall shows the process which is triggered once a participant defaults and ECC incurs losses. It comprises the financial resources described under ECC's Lines of Defence. The sequence of their usage is stipulated as follows:

Only if the losses from the default of a member exceed its individual margins, its individual default fund contribution and ECC's dedicated own resources, default fund contributions of other non-defaulting members will be used.

Individual margins of non-defaulting members are never used to cover any losses of defaulting members.

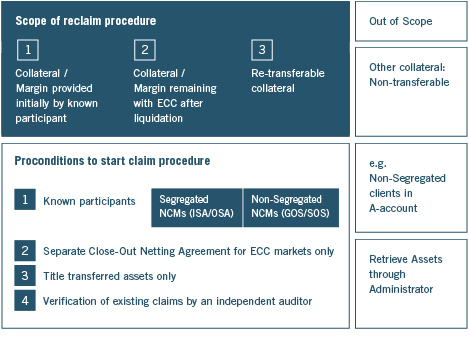

Reclaim Procedure

ECC has established a claim procedure for non ISA/OSA segregated collateral remaining with ECC in the standard collateral pool, the simple omnibus pool or the general omnibus pool after the default procedures have been completed. Known Participants (NCMs and segregated clients) whose positions have not been transferred can reclaim some of the collateral provided to their Clearing Member under the following conditions (see also section 3.10.3 lit. b (ii) Clearing Conditions):

- ECC will on behalf of the Known Participants ask the administrator of the CM to confirm, that he will return those assets to the Known Participants without these assets becoming part of the insolvency estate. If such confirmation can be achieved within a time frame determined by ECC, ECC will return the respective assets to the insolvency administrator if the Known Participants agree.

- If a Known Participant does not agree, ECC will return assets to the Known Participant.

- The return of assets is subject to a verification of existing claims of the Known Participant from providing assets to his CM. The verification will be performed by independent auditors that have been approved by ECC.

- ECC will only return assets to the Known Participants if:

- There is no close out netting agreement between the Known Participant and his CM that covers ECC and other Clearing Houses or other entities

- Assets have been title transferred

- The sum of the returned assets does not exceed the margin requirement of the Known Participant

Assets in this context will likely be cash and not the assets originally posted by the Known Participant to the CM. If more than one Known Participant request the return of assets ECC will distribute them pro rata. Any remaining claims after the distribution by ECC have to be addressed to the administrator.