Non-Clearing Members

Requirements

Non-Clearing Members (NCMs) are companies without a clearing license. They take part in clearing as clients of a Clearing Member (CM) on the markets for which ECC provides clearing services.

For the transactions to be cleared, the NCM has to contact a CM of his choice. The legal relationship between an NCM and a CM is defined by the Clearing Conditions and the NCM Agreement. Within this relationship, the CM takes over financial settlement in order to perform financial transactions through one interface.

Admission by ECC constitutes a fundamental precondition for exchange trading for NCMs. It ensures that settlement, delivery and hedging of the transactions are secured by the clearing house.

The following requirements are necessary for admission by ECC:

- completion of a Know-Your-Customer (KYC) Questionnaire if requested by ECC and passing of the ECC KYC assessment or other applicable access policies of ECC

- completion of a corresponding NCM Agreement with the co-operating Clearing Member and ECC (PRIOR the admission).

- the clearing license of the Clearing Member co-operating with said Non-Clearing Member has to comprise the product concerned

- the conclusion of a balance group agreement with the respective TSO, in case of physical delivery

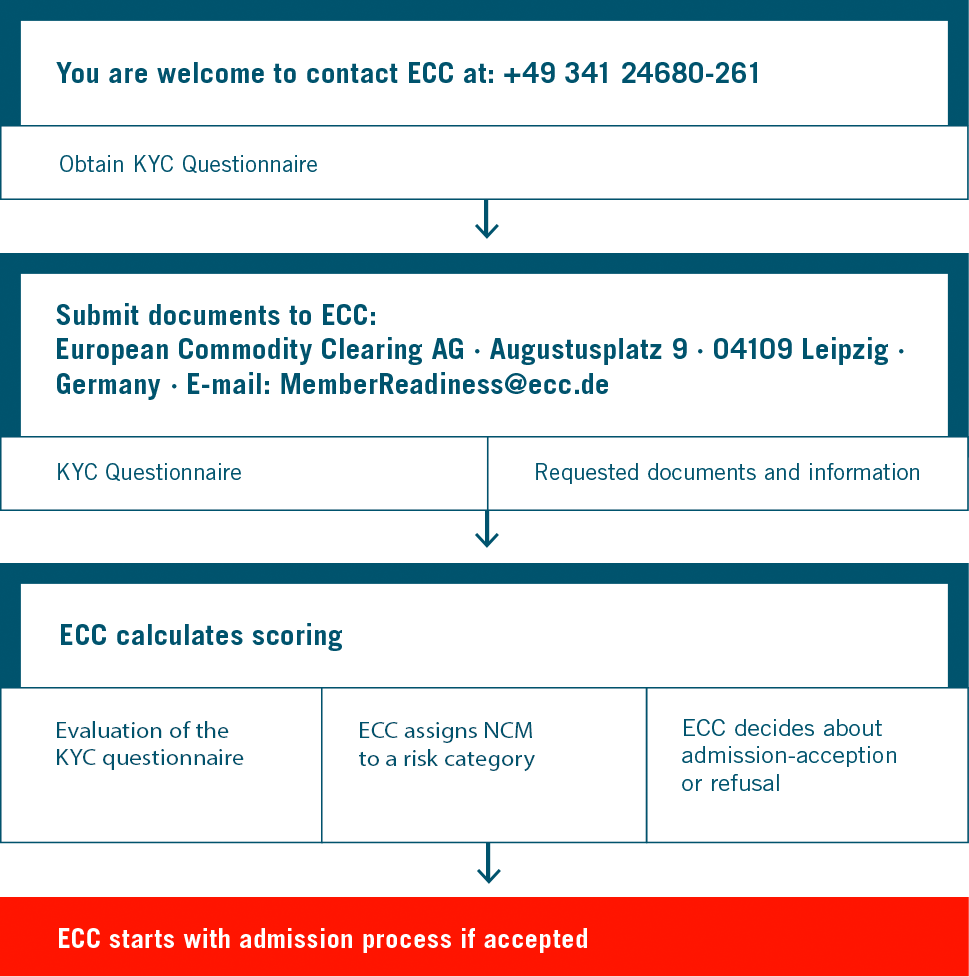

KYC Procedure

A company applying as a Non Clearing Member at ECC has to pass the KYC (Know-Your-Customer) process at ECC. He needs to provide a signed and completed KYC questionnaire if requested by ECC. Additionally the following documents are required:

- Commercial registry extract (no older than 3 months)

- Financial statements from the last fiscal year. If no financial statement is available, business plan of the business activity for the next 3 years

- Organizational chart explaining the shareholder/ownership' structure, up to the Ultimate Parent level as well as the direct and indirect beneficial owners.

Based on the information given in the KYC questionnaire, the accompanying documents and other information (e.g. Internet, Reuters) ECC calculates a score. Based on this score the applicant is assigned to a risk category which will decide whether to accept or refuse the company’s application.

In case the NCM notifies any material change according to ECC Clearing Conditions section 2.2.3 ECC might request an updated KYC Questionnaire.

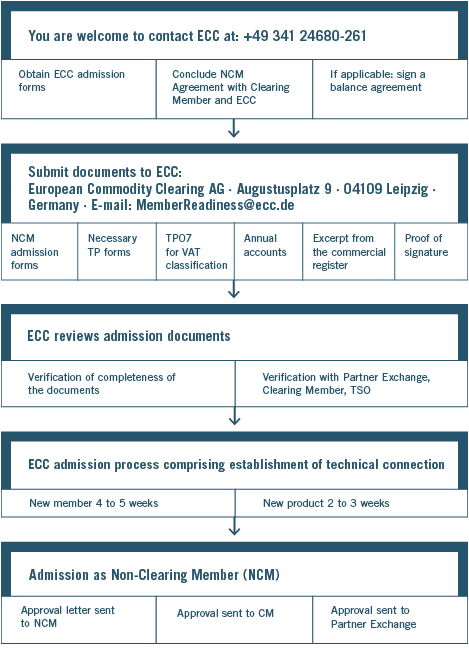

Admission Process

The admission by ECC is divided in two parts:

- Admission as Non-Clearing Member:

At the beginning of each membership stands the admission as NCM. Therefore, NCM-forms need to be handed in. - Admission for Clearing of different products:

The second part of admission is the application for clearing of different products traded on ECC’s Partner Exchanges. Therefore, TP-forms have to be sent in. - To receive access to ECC’s clearing and settlement systems the NCM has to provide the respective technical form.

After receiving the originals of all documents, ECC will commence the admission process. The documents will be examined for completeness as well as correctness. For your convenience you may also send us a scan in advance in order to avoid mistakes and guarantee a swift admission process.

As soon as all confirmations are available, admission will be issued and information sent to the Partner Exchange and Clearing Member.

Admission Process - Overview

Extension of an NCM Membership - New Products

To extend the existing NCM license to another product the respective Trading Participant Form has to be submitted to ECC. The NCM-Agreement (NCM02) is exchange-specific. Therefore, we kindly ask you to check if it has to be renewed.