Prisma Migration

ECC Prisma Migration

ECC is enhancing the derivatives margining model to provide clearing members with more accurate and risk-aligned margin calculations. This upgrade to "ECC Prisma for Commodities" will improve capital efficiency and align our systems with a leading industry standard.

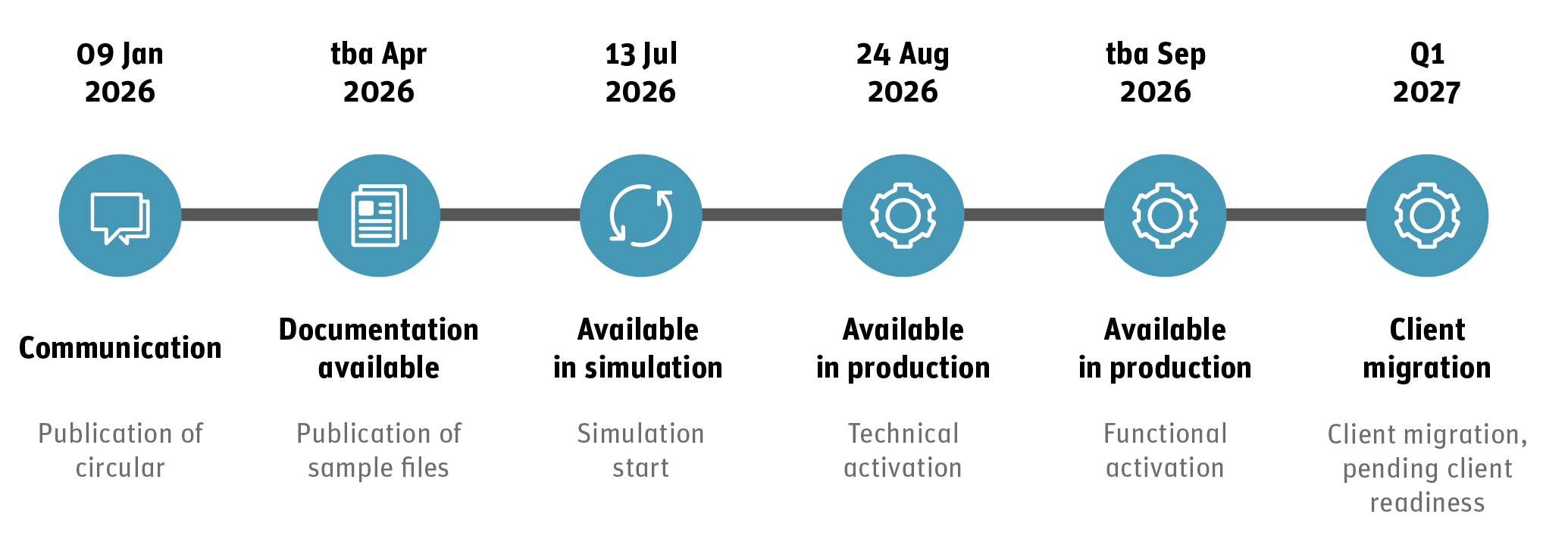

Simulation start: 13 July 2026

Functional activation: September 2026

Client migration start: Q1 2027

System Documentation

Central Coordinators and their Deputies can access the documentation in the Member Section of the Deutsche Börse Group client portal by navigating to Resources > ECC > ECC Prisma. Access is limited to registered users.

Release Items/Participants Requirements

| Scope Item | Details | Action Item |

|---|---|---|

| Transparency Enabler (TE) file WGFCT & Member Report (CP043) | The technical interfaces for files and member reports will be updated to align with those used by Eurex Clearing AG. With this initiative a:

will be introduced. This standardisation creates consistency across platforms and provides more detailed risk information. | Independent Software Vendors and clearing members with their own risk applications, are kindly asked to use the test sample files (available in April 2026) to prepare for these technical changes. |

| Functional Activation & Production Data (Available: Sep 2026) | From September 2026, the new model will be functionally activated, which makes production data available to clients through the updated TE files, comparison reports, and the Cloud Prisma Margin Estimator (CPME). This enables clients to understand, replicate, and forecast margin calculations with their portfolio data, ensuring better planning, risk assessment, and a smooth migration in 2027. | Clients are asked to use the production data to simulate the margin impact on their portfolios and prepare for the migration. |

| New Margin Model (Start: Q1 2027) | ECC is replacing the current SPAN model with the more advanced ECC Prisma for Commodities. The new portfolio-based model aligns initial margin requirements more closely with the actual risk of client’s portfolio, which leads to improved capital efficiency. | No action required. |