Regulatory Framework

Regulatory Framework

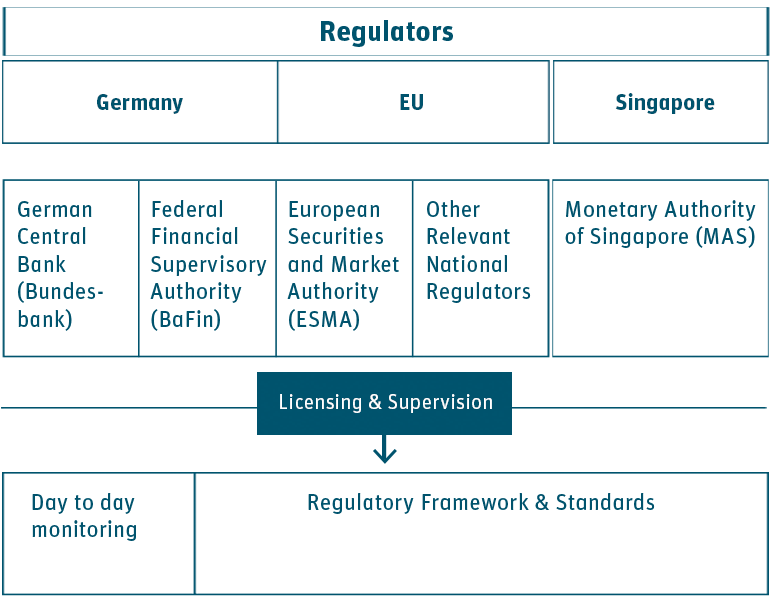

As of 11 June 2014, ECC has been granted a Central Counterparty license according to Article 14 (1) of the Regulation (EU) 648/2012 on OTC derivatives, central counterparties, and trade repositories (EMIR). This license authorizes ECC to offer services and activities in the European Union. It covers commodity transactions or transactions with commodities as the underlying. ECC is supervised by the German Federal Financial Supervisory Authority, the German Central Bank and the European Securities and Markets Authority:

ECC is a member of the European Association of Clearing Houses (EACH) and complies with the risk standards promoted by EACH, namely the CPSS-IOSCO principles for Financial Market Infrastructures.

With effect from 26 March 2018 ECC is recognized by the Monetary Authority of Singapore (MAS) as a recognized clearing house (RCH) in Singapore according to section 51 (2) of the Securities and Futures Act (SFA). ECC's recognition is restricted to its operation of a clearing facility for the clearing of specified derivative contracts only. A collection of relevant links to the information ECC discloses to Participants according to the SFA can be found in ECC’s Singapore Risk Disclosures document.

Risk Committee

The Risk Committee of ECC has at least 5 voting members and if required independent experts in a non-voting capacity. The committee meets at least four times a year and advises the ECC management board with regard to questions of risk management.

The current members of the committee are:

| Member | Representative of |

|---|---|

| Thomas Laux (Risk Advisory Coach) | Supervisory Board Member; as Chairperson of the Risk Committee |

| Mario Claeys (Founder and Managing Director, CMeXs) | Supervisory Board Member; as Deputy Chairperson of the Risk Committee |

| Wolfgang Behr (Head of Trading Credit Risk Management, Unicredit Bank AG) | Clearing Member Representative |

| Sam Masso (Associate Director Commodities & Global Markets, Macquarie) | Clearing Member Representative |

| Aurélien Martini (CCP Risk Analyst, Société Générale) | Clearing Member Representative |

| Ed van der Star (Global Manager Credit Risk Management, ABN AMRO) | Clearing Member Representative |

| Haiyi Lan (Credit Risk Officer – Funds & CCPs, BNP Paribas) | Clearing Member Representative |

| Mathieu Doucy (Vice President Trading Support, Total Energies Gas & Power Ltd.) | Client Representative |

| Annika Straulino (Head of Market Risk, EnBW Energie Baden-Wuerttemberg AG) | Client Representative |

| Dr. Michael Jost (Head of Credit Risk Control, RWE Supply & Trading GmbH) | Client Representative |

| Dr. Rüdiger Schils (Vice President Risk Management, Statkraft Markets GmbH) | Client Representative |

| Yasmina Semlali (Chief Risk Officer, ENGIE Global Markets) | Client Representative |

Further Information

| Publishing date | Title | File |

|---|---|---|

| 2025-01-01 | ECC Risk Committee - Terms of Reference | pdf (139 KB) |

Clearing Working Group

In the ECC Clearing Working Group, which meets quarterly, ECC informs the participants about ECC’s ongoing and new projects/initiatives related to all markets cleared by ECC and ECC’s Risk Management. Additionally, ECC presents the developments of its Partner Exchanges (e.g. market volume, registered participants).

Participants of the ECC Clearing Working Group are:

- ECC’s Clearing Members

- Partner Exchanges and

- selected Non-Clearing Members.

Downloads

Please find downloads about regulation at ECC below.

For more information about the complaints procedure at ECC here: Complaints Management.

| Publishing date | Title | File |

|---|---|---|

| 2025-09-29 | Segregation at ECC AG | pdf (354 KB) |

| 2024-05-16 | Singapore Risk Disclosures | pdf (106 KB) |

| 2022-07-25 | Appeal, Complaint, Disciplinary (ACD) procedures | pdf (201 KB) |