Derivative Market Scenarios

Portability Scenarios

In the case of default of a Clearing Member, ECC might be able to transfer assets and positions of clients of the defaulting Clearing Member to other Clearing Members. According to EMIR Article 39 and 48 ECC has the obligation to trigger the procedures to transfer assets and positions of segregated clients. The success of the transfer depends on the individual circumstances of the default. For stress testing ECC therefore has developed the following portability scenarios:

- No transfer at all: All Non Clearing Members positions and assets remain with the defaulting Clearing Member. Positions are netted and have to be liquidated.

- Complete transfer: It is assumed that the positions and assets of all client accounts (i.e. where the Non Clearing Member is not identical to the Clearing Member) can be transferred to another Clearing Member.

- Partial transfer: Only Non Clearing Members having an S&P-rating better than BBB+ are assumed to be transferred.

For portability scenario 2 and 3 a special case is considered that the biggest Non Clearing Member (in terms of its stress loss) of the defaulting Clearing Member could not be transferred.

Historical Market Scenarios

In order to perform historical stress tests on the derivative market ECC considers all historical price movements since January 1, 2006. For each historical day and for each future contract price differences are determined from the historical price differences scaled by the ratio of current margin parameter and the margin parameter for the historical date to match the current volatility level. For options the price differences are calculated via the Black76 algorithm using the underlying price and a stressed implied volatility.

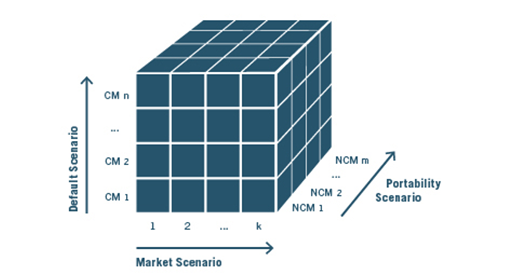

The simulated price differences are aggregated for the netted portfolio of the defaulting Clearing Member for each portability scenario. The 99.9% quantile of the historical aggregated price differences defines the Clearing Member’s stress profit and loss for each portability scenario.

Hypothetical Market Scenarios

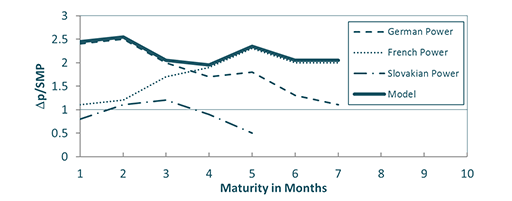

ECC’s approach to define hypothetical scenarios to simulate extreme but plausible market conditions is history-based. To identify extreme scenarios which might be caused by political decisions (e.g. Germany’s moratorium of atomic power), climate events (e.g. mild winter), technical influences (e.g. new gas pipelines) or external market factors (e.g. currency fluctuations) ECC uses the ratio of change of risk factor Δp to the then valid single margin parameter SMP as a measure of stress (i.e. Δp/SMP):any exceedance of the margin parameter by the risk factor during a period of maximum 2 trading days qualifies as an extreme but plausible market movement. The scenario is stored as the price change relative to the then applicable margin parameter.

As a main differentiator to the historical scenarios, the hypothetical scenarios generalize the movements of the markets, i.e. the occurrence of an event in one market is also extrapolated to other markets of the same asset class. The stressed market scenario is then found as the conservative envelope of all price developments of the analyzed contracts of the asset class, e.g. all power month contracts of a given maturity.

The hypothetical scenario values are rescaled by the current margin parameters to apply the price changes to the Clearing Member’s portfolio under the defined portability scenarios. Options are treated similarly to the historical simulation by stressing the implied volatility.

Default Scenarios

The shortfall per Clearing Member is defined as the sum of profit and loss (where loss would appear as a negative amount) and the deposited margin collaterals.

For the historical and hypothetical simulation and each for the several portability scenarios the shortfalls of the Clearing Members are determined. The final stress test result on the derivative market is given as the lowest shortfall under the assumption that the two largest Clearing Members (in terms of shortfall) would default simultaneously.