Admission

Admission as DCP Member

From a legal perspective, DCP members are Clearing Members who hold a dedicated DCP clearing license for the clearing of spot market transactions. The legal relationship between the DCP member and ECC is governed by the ECC Clearing Conditions.

A clearing license for DCP membership is granted upon successful completion of the admission process. Below, you will find an overview of the admission requirements and the key steps involved in the onboarding procedure.

Companies interested solely in participating in the German national Emissions Trading Scheme (nEHS) may apply for a simplified nEHS-DCP membership. More information is available here.

| Title | Type | Category | Publishing date | File |

|---|---|---|---|---|

| DCP Introduction Slide Deck | Explainer | Direct Clearing Participant (DCP) | 2025-12-11 | pdf (1 MB) |

Approved Markets

The following markets have been approved by ECC for DCP clearing. ECC endeavours to continuously expand the list of DCP approved markets.

| Exchange | Product Name | |

| BSP | Power Spot (day-ahead, intraday continuous, intraday auctions) | |

|

EPEX SPOT | Power Spot (day-ahead, intraday continuous, intraday auctions) Certificates | |

| EEX | Natural Gas Spot (within-day, day-ahead) Certificates | |

| HUPX | Power Spot (day-ahead, intraday continuous, intraday auctions) | |

| SEMOpx | Power Spot (day-ahead, intraday continuous, intraday auctions) | |

Admission Requirements

The following requirements are necessary for admission by ECC:

- Completion of a Know-Your-Customer (KYC) Questionnaire if requested by ECC and passing of the ECC KYC assessment or other applicable access policies of ECC

- Bank account at a Settlement Bank for facilitating DCP payments (see DCP Payment)

- Approval as a Trading Participant for at least one ECC approved spot market where DCP Model is available

- For Participants of power and gas spot markets: the conclusion of a balance group agreement with the respective TSO

- Equity of at least EUR 50,000. The equity is calculated incl. subscribed capital, capital reserves, retained income less any losses incurred in the course of the year and less intangible assets.

Increases of the subscribed capital during a given year shall be proven by means of the submission of the registration message. A DCP member can increase the equity by means of bank guarantees or guarantees of a parent company accepted by ECC. - Contribution to the Default Fund (for DCP members active on UK power spot markets and/or members providing guarantees as collateral)

- The company must be established in a country approved by ECC for participation in the DCP model. See below for the current list of DCP-eligible countries.

DCP Eligible Countries

The table and map below provide an overview of countries currently approved by ECC for the DCP model. Only companies domiciled in one of these countries are eligible to apply for DCP membership.

DCP Eligible Countries

| Austria |

| Belgium |

| Crotia |

| Czech Republic |

| Denmark1 |

| Estonia |

| Finland |

| France |

| Germany |

| Hungary |

| Ireland |

| Italy |

| Latvia |

| Lithuania |

| Netherlands |

| Poland |

| Slovenia |

| Spain |

| Sweden |

| Switzerland |

| United Kingdom |

1 Acceptable legal forms:

- public limited company (in Danish: aktieselskab)

- privat limited company (in Danish: anpartsselskab)

- partnership (in Danish: interessentskab)

- limited partnership (in Danish: kommanditselskab)

- an association with limited liability (in Danish: “forening med begrænset ansvar”)

- company with limited liability (in Danish: “selskab med begrænset ansvar”)

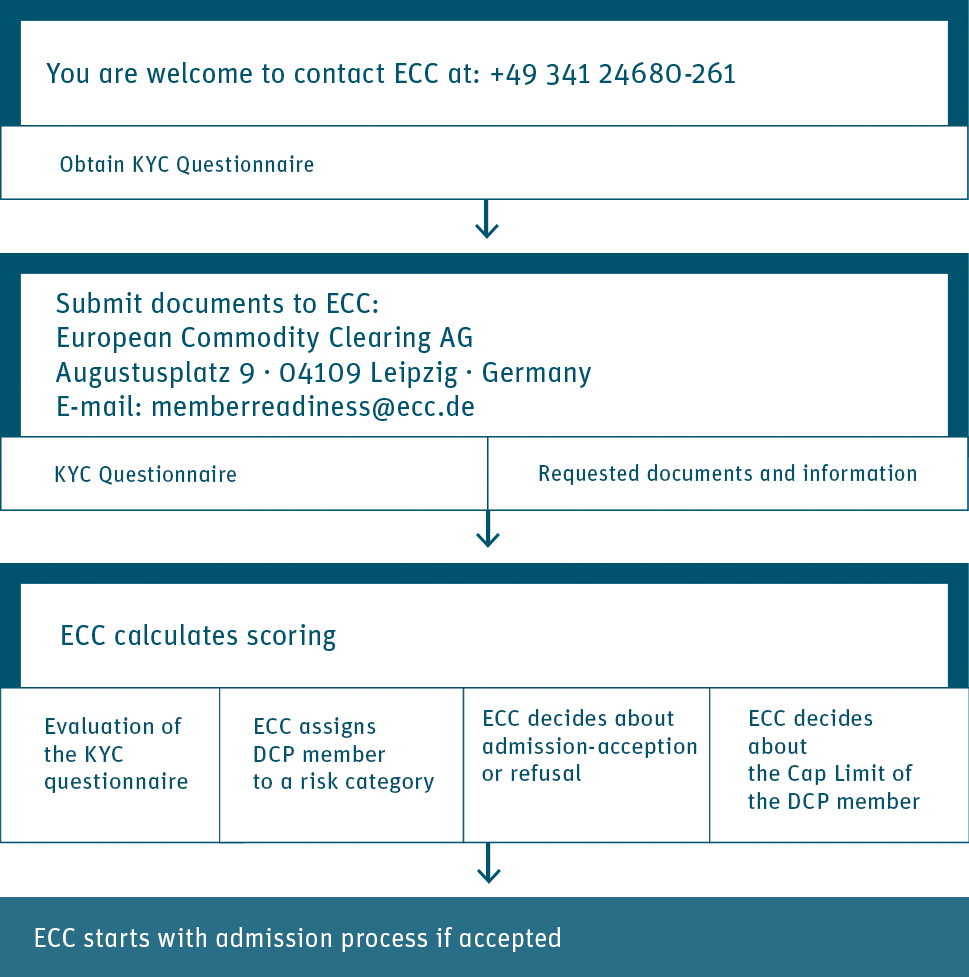

KYC Procedure

A company applying as a DCP member at ECC has to pass the KYC (Know-Your-Customer) process at ECC. The company needs to provide a signed and completed KYC questionnaire if requested by ECC. Additionally, the following documents are required:

- Commercial registry extract (no older than 3 months)

- Financial statements from the last fiscal year. If no financial statement is available, business plan of the business activity for the next 3 years

- Organisational chart explaining the shareholder/ownership structure, up to the Ultimate Parent level as well as the direct and indirect beneficial owners

Based on the information given in the KYC questionnaire, the accompanying documents and other information (e.g. Internet, Reuters) ECC calculates a score. Based on this score the applicant is assigned to a risk category which will decide whether to accept or refuse the company’s application. In case of an acceptance of the company as DCP member, ECC also decides on the Cap Limit available for the client.

Cap Limit

The maximum total limit granted to a DCP member is limited by the Cap Limit. The Cap Limit is determined on the basis of the member’s overall risk profile. Even if a DCP member deposits more collateral than the Cap Limit, the maximum collateral considered for the trading limit calculation is the amount of the Cap Limit, not more.

ECC derives the respective Cap Limit on the basis of the applicant's financial strength and internally defined credit-risk-based criteria.

The Cap limit is calculated as part of the KYC process and reassessed once a year for each member.

Material changes of the member

In case the DCP member notifies any material change according to ECC Clearing Conditions section 2.1.5 ECC might request an updated KYC Questionnaire.

Admission Process

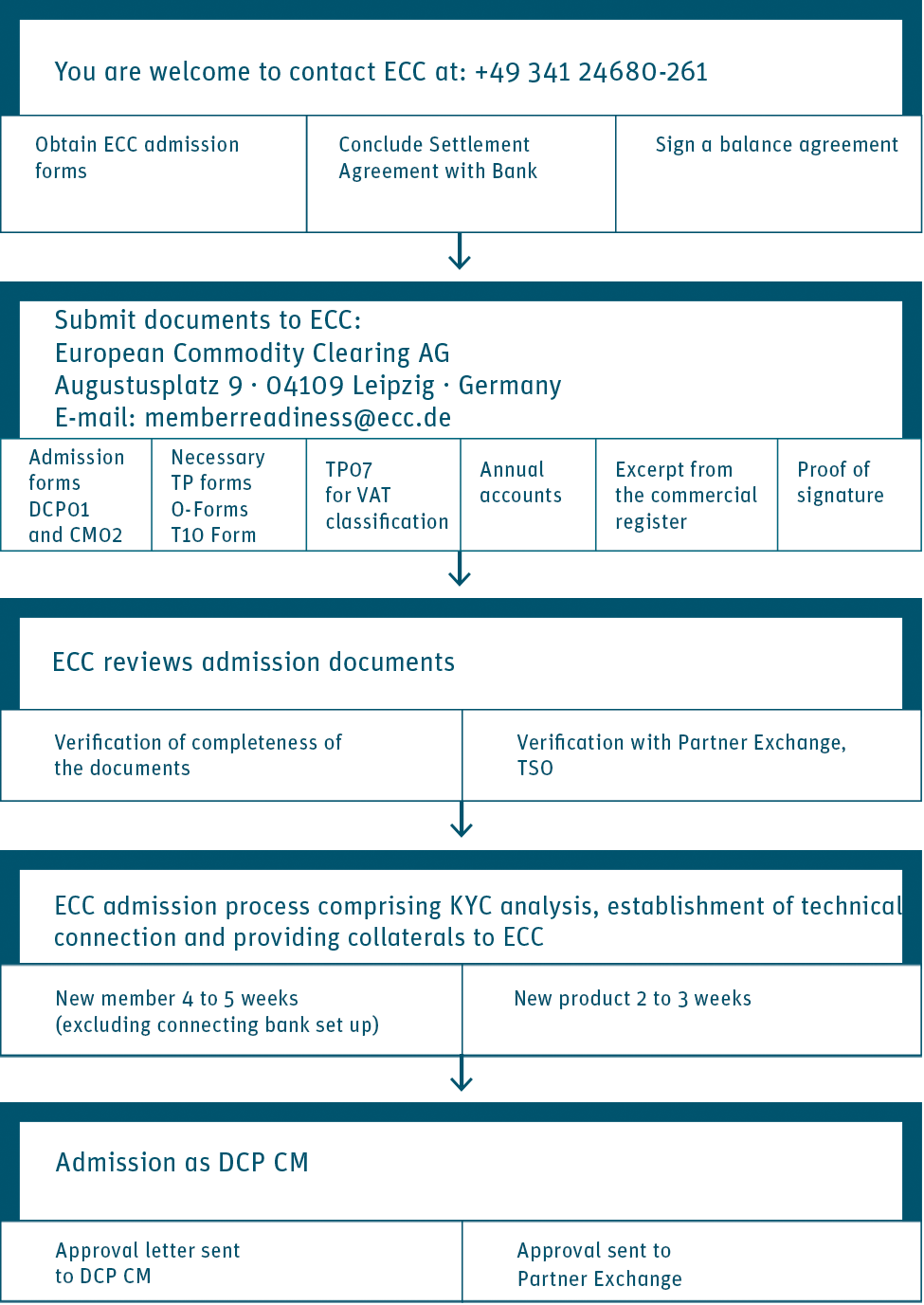

The admission by ECC is divided in two parts:

- Admission as DCP member:

At the beginning of each membership stands the admission as DCP member. Therefore, a DCP-form needs to be handed in. Additionally a clearing agreement (CM02) between the DCP member and ECC has to be signed. - Admission for clearing of different products:

The second part of admission is the application for clearing of different spot products traded on ECC’s Partner Exchanges. Therefore, TP-forms have to be submitted to ECC. - To receive access to ECC’s clearing and settlement systems the DCP member has to provide the respective technical form.

- For the limit distribution process the respective operational form is required. More details on the process and accepted collaterals can be found here.

After receiving a complete admission package including all required documents, ECC will commence the admission process. The documents will be examined for completeness as well as correctness.

As soon as all confirmations are available, admission will be issued and information sent to the Partner Exchange.

Extension of a DCP Membership - New Products

To extend the existing DCP Clearing license to another product the respective Trading Participant Form has to be submitted to ECC. A DCP member can only trade on spot markets which fulfil ECC’s requirements to the DCP model.